Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

**PREFACE**

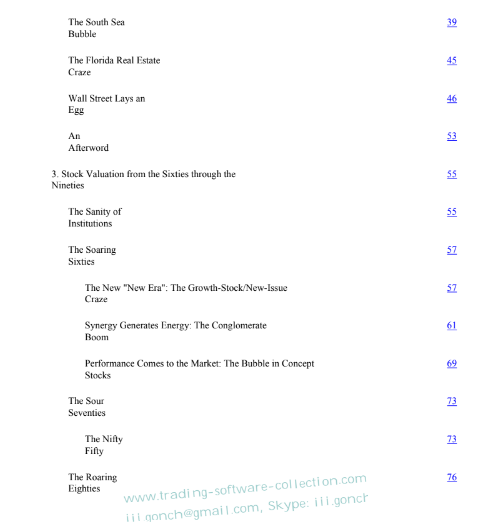

It has now been close to thirty years since I began writing the first edition of A Random Walk Down Wall Street. The message of the original edition was a very simple one: Investors would be far better off buying and holding an index fund than attempting to buy and sell individual securities or actively managed mutual funds. I boldly stated that buying and holding all the stocks in a broad, stock-market average as index funds do was likely to outperform professionally managed funds whose high expense charges and large trading costs detract substantially from investment returns. Now, some thirty years later, I believe even more strongly in that original thesis, and there’s more than a six-figure gain to prove it. The chart on the following page makes the case with great simplicity. It shows how an investor with $10,000 at the start of 1969 would have fared investing in a Standard & Poor’s 500-Stock Index Fund. For comparison, the results are also plotted for a second investor who instead purchased shares in the average actively managed fund. The difference is dramatic.

Through June 30, 1998, the index investor was ahead by almost $140,000, with her original $10,000 increasing thirty-to-one fold to $311,000. And the index returns were calculated after deducting the typical expenses (2/10 of 1 percent) charged for running an index fund. Why then a seventh edition of this book? If the basic message hasn’t changed, what has? The answer is that there have been enormous changes in the financial instruments available to the public. A book meant to provide a comprehensive investment guide for individual investors needs to be updated to cover the full range of investment products available. In addition, investors can benefit from a critical analysis of the wealth of new information provided by academic researchers and market professionals made comprehensible in prose accessible to everyone with an interest in investing. There have been so many bewildering claims about the stock market that it’s important to have a book that sets the record straight.

Over the past quarter century, we have become accustomed to accepting the rapid pace of technological change in our physical environment. Innovations such as cellular and video telephones, cable television, compact discs, microwave ovens, laptop computers, the Internet, e-mail, and new medical advances from organ transplants and laser surgery to nonsurgical methods of treating kidney stones and unclogging arteries have materially affected the way we live. Financial innovation over the same period has been equally rapid. In 1973, when the first edition of this book appeared, we did not have money market funds, NOW accounts, ATMs, index mutual funds, equity-exempt-tax funds, emerging-market funds, floating-rate notes, inflation protection securities, tax-exit REITs, Roth IRAs, zerocoupon bonds, S&P index futures and options, and new trading techniques such as “portfolio insurance” and “program trading,” just to mention a few of the changes that have occurred in the financial environment. Much of the new material in this book has been included to explain these financial innovations and to show how you as a consumer can benefit from them. This edition takes a hard look at the basic thesis of earlier editions of Random Walk that the market prices stocks so efficiently that a blindfolded chimpanzee throwing darts at the Wall Street Journal can select a portfolio that performs as well as those managed by the experts. Through the past thirty years that thesis has held up remarkably well.

More than two-thirds of professional portfolio managers have been outperformed by the unmanaged S&P 500-Stock Index. Nevertheless, a number of studies by academics and practitioners, completed during the 1980s and 1990s, have cast doubts on the validity of the theory. And the stock market crash of October 1987 raised further questions concerning the vaunted efficiency of the market. This edition explains the recent controversy and reexamines the claim that it’s possible to “beat the market.” I conclude that reports of the death of the efficient-market theory are vastly exaggerated. Will, however, review the evidence on a number of techniques of stock selection that are believed to tilt the odds of success in favor of the individual investor. The book remains fundamentally a readable investment guide for individual investors.

As I have counseled individuals and families about financial strategy, it has become increasingly clear to me that one’s capacity for risk bearing depends importantly upon one’s age and ability to earn income from non-investment sources. It is also the case that the risk involved in most investments decreases with the length of time the investment can be held. For these reasons, optimal investment strategies must be age related. Chapter Thirteen, entitled “A Life-Cycle Guide to Investing,” should prove very helpful to people of all ages. This chapter alone is worth the cost of a high-priced appointment with a personal financial adviser. Finally, the facts and figures in the book have been completely

**PREFACE** (continued) revised and updated.

I survey the stock and bond markets at the end of the twentieth century and present a set of strategies that should successfully carry investors into the new millennium. My debts of gratitude to those mentioned in earlier editions continue. In addition, I must mention the names of a number of people who were particularly helpful in making special contributions to the seventh edition. These include James Litvack, Gabrielle Napolitano, Abby Joseph Cohen, James Riepe, George Sauter, John Bogle, Leila Heckman, Will McIntosh, Keith Mullins, Jim Troyer, Andrew Engel, Mark Thompson, Steven Goldberg, Willy Spat, and David Twardock. Special thanks go to Walter Lenhard and Andrew Clarke of The Vanguard Group of Investment Companies, who assembled much of the financial data on investment returns used in this edition, and to Shane Antos and Jonathan Curran, who provided indispensable and superb research assistance. Lugene Whitley made extraordinary contributions in transforming various illegible drafts and dictating tapes into readable text.

Phyllis Durepos also provided valuable typing assistance. Ed Parsons and Mark Henderson of W. W. Norton provided indispensable assistance in bringing this edition to publication. Patricia Taylor continued her association with the project and made extremely valuable editorial contributions to the seventh edition. My wife, Nancy Weiss Malkiel, made by far the most important contributions to the successful completion of the past three editions. In addition to providing the most loving encouragement and support, she read carefully through various drafts of the manuscript and made innumerable suggestions that clarified and vastly improved the writing. She even corrected several errors that had eluded me and a variety of proofreaders and editors over the first four editions. Most important, she has brought incredible joy to my life. No one more deserved the dedication of a book than she.

**ACKNOWLEDGMENTS FROM EARLIER EDITIONS**

My debts of gratitude to people and institutions who have helped me with the first edition of this book are enormous in both number and degree. My academic colleagues and friends in the financial community who have contributed to various drafts of chapters are too numerous to mention. I must acknowledge explicitly, however, the many who have read through the entire manuscript and offered extremely valuable suggestions and criticisms. These include Peter Asch, Leo Bailey, Jeffrey Balashov, William Baumol, G. Gordon Biggar, Jr., Lester Chandler, Barry Feldman, William Grant, Sol Malkiel, Richard Quandt, Michael Rothschild, H. Barton Thomas, and Robert Zenowich. It is particularly appropriate that I emphasize the usual caveat that the above-named individuals are blameless for any errors of fact or judgment in these pages.

Many have warned me patiently and repeatedly about the madness of my heresies, and the above list includes several who disagree sharply with my position. Many research assistants have labored long in compiling information for this book. Especially useful contributions were made by Barry Feldman, Paul Messaris, Barry Schwartz, Greg Smolarek, Ray Soldavin, and Elizabeth Woods. Helen Talar and Phyllis Durepos not only faithfully and accurately typed several drafts of the manuscript, but also offered extremely valuable research assistance as well. Elvira Giaimo provided most helpful computer programming. Many of the supporting studies for this book were conducted at Princeton’s Financial Research Center.

A vital contribution was made by Patricia Taylor, a professional writer and editor. She read through two complete drafts of the book and made innumerable contributions to the style, organization, and content of the manuscript. She deserves much of the credit for whatever lucid writing can be found in these pages. I am also grateful to Arthur Lipper Corporation for permission to use their mutual fund rankings, Wiesenberger Investment Services for the use of their data in many of my tables, Moody’s Investors Service for permission to reproduce several of their stock charts, Consumers Union for their estimates of life insurance costs, College Retirement Equities Fund for making available to me James Farrell’s performance studies, and Smith, Barney & Co., Inc for allowing me the run of their investment library. My association with W. W. Norton & Company has been an extremely pleasant one, and I am particularly grateful to my editor, Starling Lawrence, for his invaluable help.

Finally, the contribution of Judith Malkiel was of inestimable importance. She painstakingly edited every page of the manuscript and was helpful in every phase of this undertaking. This acknowledgment of my debt to her is the largest understatement of all. In later editions I have been fortunate to have been able to continue to count on the help of many of those who assisted in the earlier editions. In addition, I want to express my gratitude for the absolutely essential assistance of John Bogle, Kelly Mingone, Ian MacKinnon, James Norris, and Melissa McGinnis of The Vanguard Group of Investment Companies; Donald Peters of T. Rowe Price; Edward Mathias of The Carlyle Group; Howard Baker of the American Stock Exchange; Frank Wisneksi and Ed Owens of Wellington Management Company; H. Bradley Perry of David L. Babson & Co.; George Putnam of Putnam Funds; George S. Johnston of Scudder, Stevens & Clark;