Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

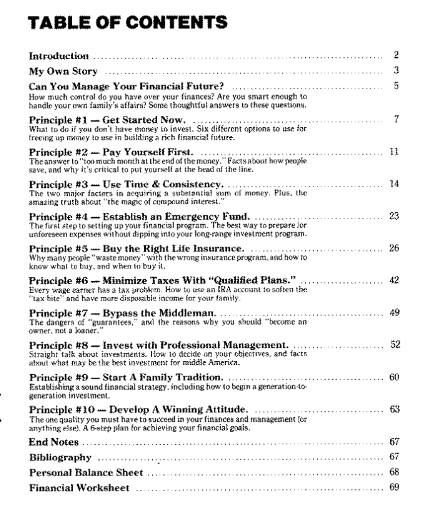

I became interested in investments and insurance completely by accident. I was coaching football and teaching in Columbus, Georgia. At a PTA meeting, I met a manager for a financial services group who believed in term insurance plus investments as a way to build financial security. Our meeting seemed destined because my accountant-cousin had talked to me about the same philosophy only a few weeks before. I had personal reasons for being interested. My father had died suddenly and tragically of a heart attack at age 48. My family was devastated. There were three children: I was in college, one brother was in high school and another brother was in the sixth grade. My mother spent the next 13 years struggling to raise her boys. My dad had too little life insurance, no will, little savings and no retirement program. When my cousin explained to me that the purpose of life insurance was protection only, and that I could have $100,000 of term insurance for the same money I was paying for $15,000 of whole life insurance, I was stunned. I thought I was protecting my family in the best way that I could. I was skeptical, so I went to the library in Columbus to research it.

As an educator, I wanted to find the answer, and knew that consumer organizations could help. I found Consumer Reports, Changing Times and a great book, What’s Wrong With Your Life Insurance? All of these publications confirmed what my cousin had told me. This revelation excited me so much that I began to talk to others about it. In most cases, I found their financial programs were disasters, just like mine and my dad’s. The man I met at the PTA meeting offered me a job selling with his company. I didn’t want to be a life insurance salesman, but I felt that I would not be selling people “just another insurance policy.” I wanted to provide my friends a chance to do what I had just learned to do — take the same money they were spending and get more value for it. I wanted to help them with investments, savings and taxes — their whole financial program. I was “fired up.” I worked quickly to get my insurance and securities licenses. I wanted to give my clients the same information I used myself to understand financial services. I wanted people to be comfortable with me.

I tried not to “talk down” to them as I’ve had salesmen do to me. I sold what I believed in myself. Then a funny thing happened. I began to earn more money with my new part-time job than I was earning as athletic director and head football coach. After two and a half years part time, I had accumulated over $40,000. I decided to make life insurance and securities my full time profession. I became totally financially independent seven years later. I did this through a combina- tion of efforts in both my business life and personal life. But if someone hadn’t opened my eyes to the basics of financial independence, I would probably still be struggling today.

Since I accidentally got started in this business, my life has been blessed in a special way. I know what a difference being secure financially has made in my own life, and the life of my family. In the last 20 years, I have had the joy of sharing the promise of financial security with many people. I have talked with thousands of families in almost every state, and have developed 10 principles into a road map for total financial independence. These general principles have worked for me personally, and for an amazing number of other families. They can help you, too, to have more financial security and peace of mind. There’s no trick to financial success. It’s so simple, if you just take the time to think it over. I hope you’ll take that time with this book.

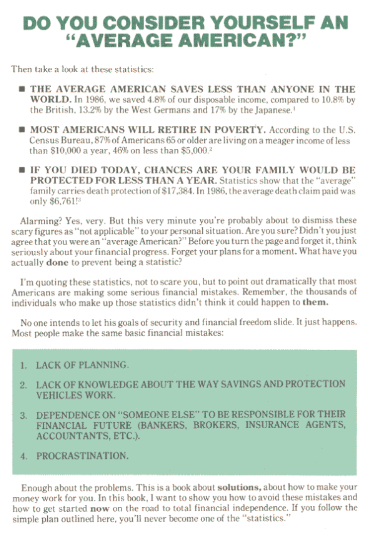

A few years ago, I heard about a speech made by a high-powered insurance executive during a seminar. The point of his speech was that the average American family was not smart enough to look at all the options and make intelligent decisions about what they needed — they needed to have someone to tell them. Ridiculous! I believe that most financial institutions have deliberately complicated a simple business to confuse the American people so they can sell them high-cost, low-quality products and services. People of average intelligence, like you and me, can understand financial matters, given the facts. There are options available, if you know what they are, that can minimize your taxes, give you more disposable income and allow for the kind of wise investments that can make you and your family more financially secure, even wealthy. What You Need Is a Gameplan.

My experience has shown me that planning and investing for your future is nothing but a simple mathematical problem, like 2 + 2 = 4, and a math problem has only one answer. I want to give you that answer. The key to financial independence is not necessarily having a lot of money to invest (most of us don’t); it’s not necessarily being in the right place at the right time. There are no tricks and gimmicks. Luck is not necessary. And you certainly don’t have to be a financial genius. All you need is a gameplan. Planning is the first step to taking control of your financial future. It doesn’t take a genius to figure out that you can’t reach a destination without a road map. You have to have a plan. It should be flexible, but firm, and (this is important) you must stick to it! Stick to the Fundamentals.