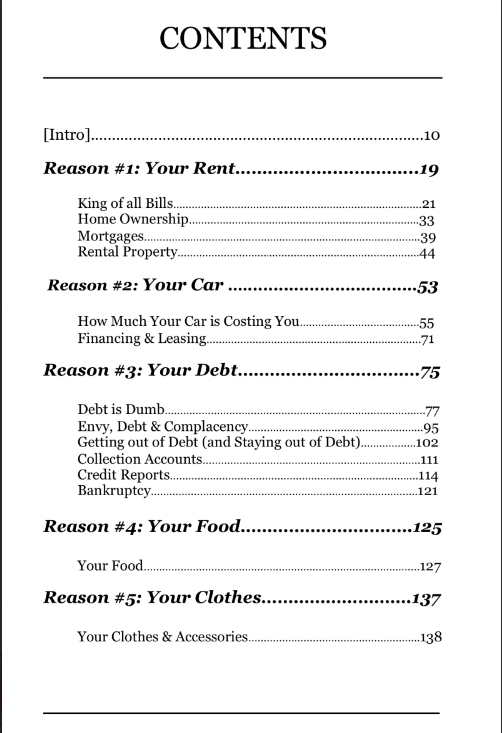

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

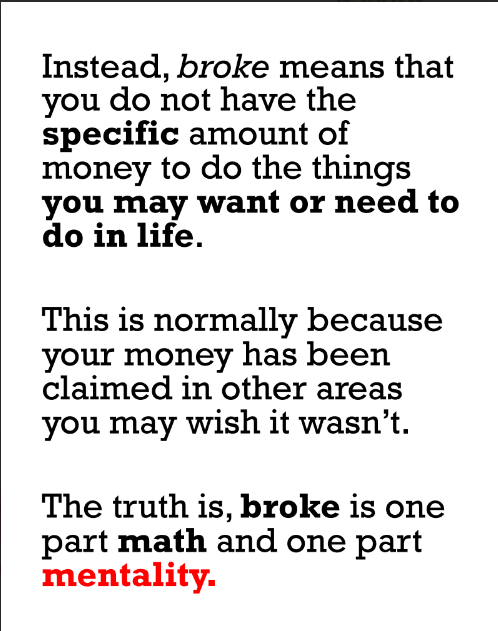

Instead, **broke** means that you do not have the **specific** amount of money to do the things you may want or need to do in life. This is normally because your money has been claimed in other areas you may wish it wasn’t. The truth is, **broke** is one part **math** and one part mentality.

We are not just **broke** with $40k in consumer debt and $100 to our names. We’re broke **and** in debt. Yes, this means that most of us…about 80-90% of the people reading this book right now, are trying to get **back** to just **broke**. Every dollar we spend while we owe more than we’re “worth” is a dollar that actually belongs to someone else. Its not our money. BofA and **Capital One** own it.

He said: “Every few weeks you come to me asking for money and telling me you’re broke. I think part of the reason is you’re paying far too much on rent each month.” She said: “Well…I would find something cheaper, but you know, I don’t want to live anywhere I’m not comfortable.” He said: “And I no longer want to lend money to people living better than I am.

Your rent: the king of all bills. The lion of your financial jungle eating all other line items in your budget at will. You see, if you only focused on cleaning up the rent portion of your budget, you would be: > 4 times as likely to be able to tackle your car expenses. > 4 times as likely to beat debt. > 4 times likely to be in position to eat whatever the heck it is you want to eat each month.

But if your aim is to strive for and eventually live the life you want to live without stressing over robbing Peter to pay Paul each month, then listen up. Understand that,

* You do not have to rent a room in someone else’s 2 bedroom apartment *forever*.

* You do not have to move yourself and your kid into your parent’s house to escape rent *forever*.

* You do not have to utilize coabode.org and combine resources with other single moms *forever*.

* You do not have to work 2 jobs *forever*.

* Your aim should be to do whatever financially you have to **today** so that you can do whatever you want financially **tomorrow**.

Another way to think of it… You currently pay $1,250/ month in rent on a $2,000 gross monthly income. Over 5 years, this becomes $75,000<< in total rent paid to someone else. What if you temporarily paid only a fraction of that amount? And what if you decided to use the remainder to pay off your debt?

As often happens at forks in the path—college graduation, quarter-life crisis, midlife crisis, kids leaving home, retirement—questions started to bubble to the surface. *Were my goals my own, or simply what I thought I should want?* *How much of life had I missed from underplanning or overplanning?* *How could I be kinder to myself?* *How could I better say no to the noise to better say yes to the adventures I* *craved?* *How could I best reassess my life, my priorities, my view of the world, my* *place in the world, and my trajectory through the world?* So many things! All the things! One morning, I wrote down the questions as they came, hoping for a glimmer of clarity. Instead, I felt a wave of anxiety. The list was overwhelming. Noticing that I was holding my breath, I paused and took my eyes off the paper. Then, I did what I often do—whether considering a business decision, personal relationship, or otherwise—I asked myself the one question that helps answer many others . . .