Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

Copyright © 2005 by Keller Williams®, Realty, International. All rights reserved. Manufactured in the United States of America. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher. 0-07-146953-2 The material in this eBook also appears in the print version of this title: 0-07-144637-0. All trademarks are trademarks of their respective owners.

Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps. McGraw-Hill eBooks are available at special quantity discounts to use as premiums and sales promotions, or for use in Corporate Training programs. For more information, please contact George Holoare at george_hoare@mcgraw-hill.com or (212) 904-4069. TERMS OF USE This is a copyrighted work and The McGraw-Hill Companies, Inc. (“McGraw-Hill”) and its licensors reserve all rights in and to the work. Use of this work is subject to these terms.

Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hill’s prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED “AS IS.” MCGRAW-HILL AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

McGraw-Hill and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. McGraw-Hill has no responsibility for the content of any information accessed through the work.

Under no circumstances shall McGraw-Hill and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

While the research for this book began in the spring of 2004, the idea was born nearly two years earlier when we interviewed Cristina Martinez for our first book, *The Millionaire Real Estate Agent*. Cristina had built an amazing real estate sales business that generated over $4 million in gross income each year by catering to residential real estate investors. The sto-ries she told inspired us and pointed us down the winding path that ends with these pages. Thanks, Cristina. I’d be remiss not to mention Michael Allen, who was my original wealth-building mentor.

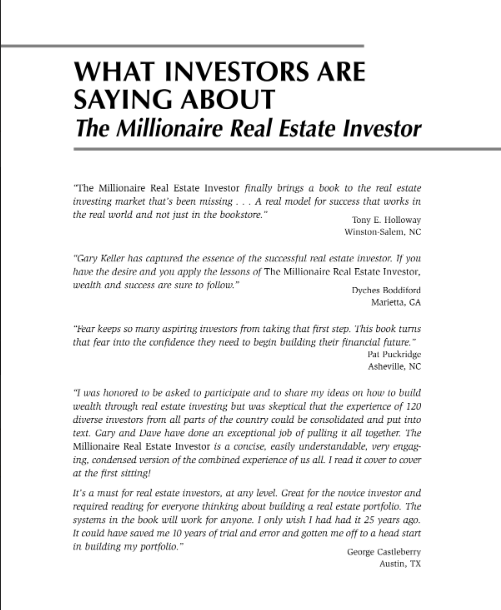

Many of the ideas in this book about money and wealth building came to me long ago during our breakfast discussions. Although Michael is no longer with us, he has been ever-present in my thoughts, especially during the writing of this book. He has my deepest gratitude. We began the search for investor interviewees by focusing on the wonderfully talented and successful real estate agents and investors we’ve known for years and kept asking for referrals until we expanded our list past those initial contacts. While everyone who agreed to be interviewed was helpful and insightful, several people really stand out because they went above and beyond to introduce us to more investors or supply more information. The first name that springs to mind is Dyches Boddiford, who, even though he didn’t really know us, extended himself again and again by putting us in touch with numerous investors, sending us his material on entity planning, and participating in teleconferences to dis- cuss the early systems and models we had developed.

Don Zeleznak George Castleberry, Tamara Fuller, Renata Circeo, Don Beck, and Elmer Diaz also participated in those teleconferences and wowed each of us with their incredible knowledge about the finer details of market analysis, property acquisition, and property management. Not only are they all incredible investors, they are all teachers at heart. Jimmy and Linda McKissack shared their insights into how they parlayed their real estate sales business into a phenomenal investing business. Jimmy’s knowledge of the Texas foreclosure process lit our way through that thicket of infor- mation. Early on, Chris Hake took it upon himself to devise a spreadsheet that laid out how many properties one would have to own and how much cash flow those properties would have to generate to net a million dollars in annual income.

George Meidhof and Michael Huang guided us through the early stages of how to set up legal entities for investments and how to structure every kind of partnership. George also visited us in Austin and walked us through the aisles of a home improvement store to show us how he shops for bargains when fixing up properties. Both Rick Villani and Rob Harrington, Jr., spent many hours with us, on the phone and in person, detailing how they built their uniquely different but highly successful investment businesses. Rick has made fixing and flipping houses into a science, and Rob’s the same with evaluating and acquiring commercial properties.

They were huge allies in the writing of this book, and their wisdom and insights touch more sections than we can name here. We’d also like to extend a special thank you to bestselling investment authors Robert T. Kiyosaki and Robert Shemin, who gener- ously took time off to talk with us at length about their investment philosophies.