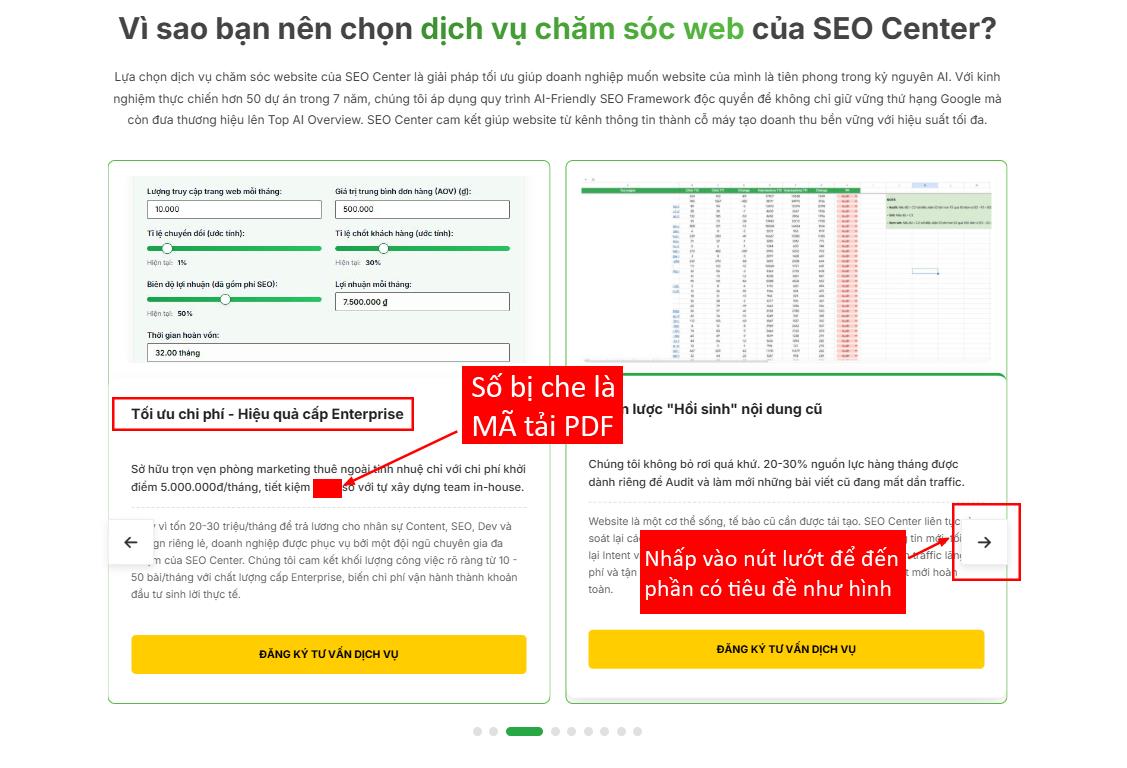

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

In the summer of 1996, I moved as a senior faculty member to The University of Michigan Business School, and over the better part of the next decade I worked closely with three very talented colleagues on issues of organization, change, culture, and growth. These colleagues were Kim Cameron, Bob Quinn, and Jeff DeGraff. Our work was with various companies in the context of leadership development programs. Over the course of that collaboration, we developed a robust and holistic framework, called the Competing Values Framework (CVF) for Growth, and I have used it ever since in work I have done with many organizations to help them reposition themselves for value-enhancing growth. One of my dreams has been to write an easily accessible business book that would convey the essence of what my colleagues and I have learned over many years of research, teaching, and consulting on this issue. This book is the result. The book has two main goals. First, it will show you how to gain clarity on your growth strategy.

Value-Enhancing Strategist A foremost researcher and respected authority on issues regarding finance and banking, Anjan Thakor offers a deeply knowledgeable perspective on the subject of value creation. He has shared his wisdom with many Fortune 500 leaders including clients such as Anheuser-Busch, Association of Corporate Growth, Borg-Warner Automotive, Brown Shoe, Bunge, Citigroup, Farm Credit System, FBI, MECS, Nestle Purina, RGA, Thompson-Reuters, Waxman Industries, and Whirlpool. In addition to his work with U.S. companies, he has also interacted with and advised corporate executives all over the world—Europe, as well as the emerging markets in Brazil and China. Scholarship Dr. Thakor is Director of the PhD Program, Director of the Institute for Innovation and Growth and John E. Simon Professor of Finance at Olin Business School at Washington University in St. Louis, Missouri. He served on the faculties of The University of Michigan and Indiana University prior to Olin, winning teaching excellence awards at all three schools. He was also a visiting professor at UCLA and Northwestern University.

A partner of the Competing Values Company, a consulting firm that assists leaders in facilitating change, innovation, and growth, Dr. Thakor, additionally, is an advisor with the Innovatrium Institute for Innovation, an innovation lab in Ann Arbor, Michigan. He has received research grants through the Bank Administration Institute, Federal Home Loan Bank Board, Garn Institute of Finance, Prochnow Educational Foundation, and the U.S. Treasury Department. As Director of the Institute for Innovation and Growth (IIG) at the Olin School of Business at Washington University, Dr. Thakor guides research on a variety of issues related to the emerging frontiers in creativity, innovation, and organizational growth.

The IIG produces books and white papers on innovation and engages in research and other types of corporate intervention projects with companies to help reinvigorate their growth engines. He has made significant contributions to his field. Dr. Thakor is former Managing Editor of the Journal of Financial Intermediation and past president of the Financial Intermediation Research Society. He has published more than 100 articles and seven books. His research has been published in leading economics and finance journals, among them American Economic Review, The Review of Economic Studies, The RAND Journal of Economics, The Economic Journal, The Journal of Finance, The Journal of Economic Theory, The Journal of Financial Economics, The Journal of Financial Intermediation, and The Review of Financial Studies.

His books include Handbook of Financial Intermediation and Banking; Competing Values Leadership; Contemporary Financial Intermediation; The Value Sphere; Becoming a Better Value Creator; Designing Financial Systems in Transition Economies; and Credit, Intermediation, and the Macro Economy. He holds a PhD in finance from the Kellogg School at Northwestern University.

Dr. Thakor is actively involved in corporate consultancy and expert witness work, including extensive work in corporate finance and banking. He is a frequent speaker at corporate events and has helped various types of organizations, including numerous Fortune 500 firms, navigate the complexities of financing, capital investment, and performance evaluation for strategic decision making. Present and past clients include Citigroup, Reuters, CIGNA, Whirlpool, Dana, RR Donnelley, Anheuser-Busch, The Limited, Landscape Structures, Allison Engine, Borg-Warner Automotive, Enterprise Car Rental, Spartech, Smurfit Stone, Nestle-Purina, Bunge, Brown Shoe, The Farm Credit System, and Essex Corporation. He has worked extensively with boards of directors of various organizations. His clients have included public and private firms, as well as small, medium, and large ones in a variety of industries. In addition, he has served as an expert witness in cases involving banking and finance issues and testified in federal courts on various occasions.

The purpose of this book is to supply, in a form suitable for lay- men, guidance in the adoption and execution of an investment pol- icy. Comparatively little will be said about the technique of analyzing securities; attention will be paid to investment principles and investors’ attitudes. We shall, however, provide a number of condensed comparisons of specific securities—chiefly in pairs appearing side by side in the New York Stock Exchange list— in order to bring home in concrete fashion the important elements involved in specific choices of common stocks. But much of our space will be devoted to the historical patterns of financial markets, in some cases running back over many decades. To invest intelligently in securities one should be fore- armed with an adequate knowledge of how the various types of bonds and stocks have actually behaved under varying condi- tions—some of which, at least, is likely to meet again in one’s own experience. No statement is more true and better applicable to Wall Street than the famous warning of Santayana: “Those who do not remember the past are condemned to repeat it.” These phenomena will have our careful consideration, and some will require changes in conclusions and emphasis from our previ- ous edition.

The underlying principles of sound investment should not alter from decade to decade, but the application of these princi- ples must be adapted to significant changes in the financial mecha- nisms and climate. The last statement was put to the test during the writing of the present edition, the first draft of which was finished in January 1971. At that time the DJIA was in a strong recovery from its 1970 low of 632 and was advancing toward a 1971 high of 951, with attendant general optimism. As the last draft was finished, in November 1971, the market was in the throes of a new decline, car- rying it down to 797 with a renewed general uneasiness about its future. We have not allowed these fluctuations to affect our general attitude toward sound investment policy, which remains substan- tially unchanged since the first edition of this book in 1949.