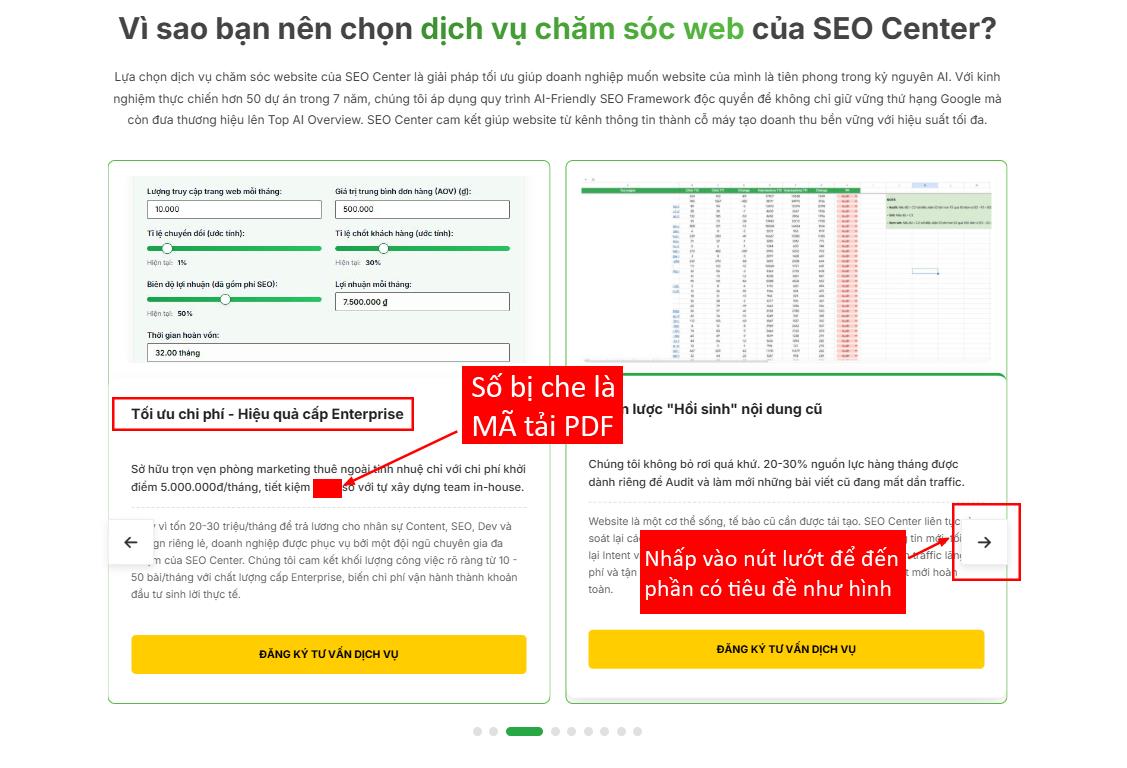

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

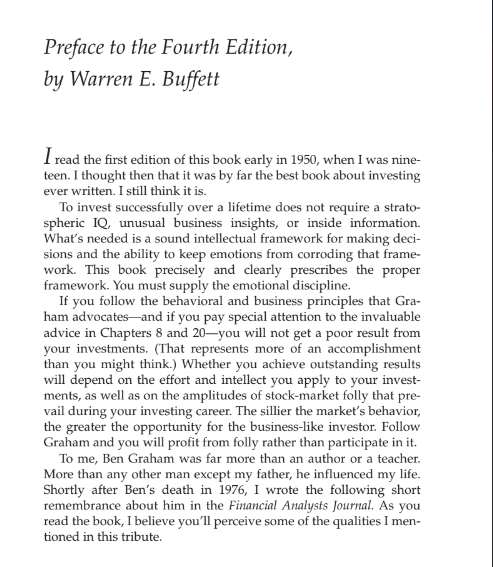

Several years ago Ben Graham, then almost eighty, expressed to a friend the thought that he hoped every day to do “something foolish, something creative and something generous.” The inclusion of that first whimsical goal reflected his knack for pack- aging ideas in a form that avoided any overtones of sermonizing or self-importance. Although his ideas were powerful, their delivery was unfailingly gentle. Readers of this magazine need no elaboration of his achievements as measured by the standard of creativity. It is rare that the founder of a disci- pline does not find his work eclipsed in rather short order by successors. But over forty years after publication of the book that brought structure and logic to a disorderly and confused activity, it is difficult to think of pos- sible candidates for even the runner-up position in the field of security analysis. In an area where much looks foolish within weeks or months after publication, Ben’s principles have remained sound—their value often enhanced and better understood in the wake of financial storms that demolished flimsier intellectual structures.

His counsel of soundness brought unfailing rewards to his followers—even to those with natural abilities inferior to more gifted practitioners who stumbled while follow- ing counsels of brilliance or fashion. A remarkable aspect of Ben’s dominance of his professional field was that he achieved it without that narrowness of mental activity that concen- trates all effort on a single end. It was, rather, the incidental by-product of an intellect whose breadth almost exceeded definition. Certainly I have never met anyone with a mind of similar scope. Virtually total recall, unending fascination with new knowledge, and an ability to recast it in a form applicable to seemingly unrelated problems made exposure to his thinking in any field a delight.

But his third imperative—generosity—was where he succeeded beyond all others. I knew Ben as my teacher, my employer, and my friend. In each relationship—just as with all his students, employees, and friends—there was an absolutely open-ended, no-scores-kept generosity of ideas, time, and spirit. If clarity of thinking was required, there was no better place to go. And if encouragement or counsel was needed, Ben was there. Walter Lippmann spoke of men who plant trees that other men will sit under. Ben Graham was such a man. Reprinted from the Financial Analysts Journal, November / December 1976.

How did Graham do it? Combining his extraordinary intellectual powers with profound common sense and vast experience, Graham developed his core principles, which are at least as valid today as they were during his lifetime: * A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price. * The market is a pendulum that forever swings between unsustain- able optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap).

The intelligent investor is a realist who sells to optimists and buys from pessimists. * The future value of every investment is a function of its present price. The higher the price you pay, the lower your return will be. * No matter how careful you are, the one risk no investor can ever eliminate is the risk of being wrong. Only by insisting on what Graham called the “margin of safety”—never overpaying, no mat- ter how exciting an investment seems to be—can you minimize your odds of error. * The secret to your financial success is inside yourself. If you become a critical thinker who takes no Wall Street “fact” on faith, and you invest with patient confidence, you can take steady advantage of even the worst bear markets. By developing your discipline and courage, you can refuse to let other people’s mood swings govern your financial destiny. In the end, how your invest- ments behave is much less important than how you behave.

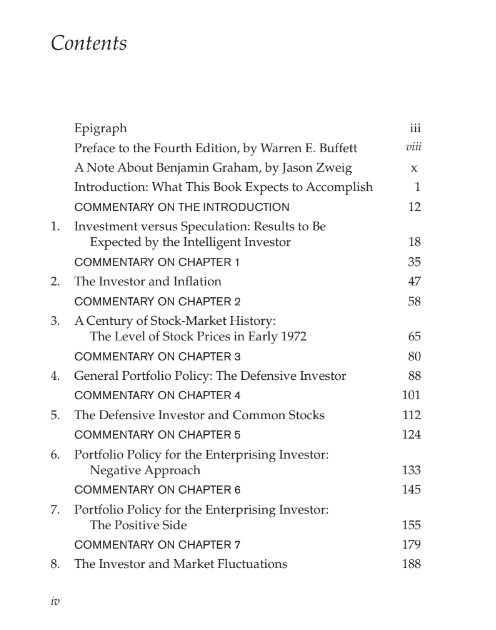

The purpose of this book is to supply, in a form suitable for lay- men, guidance in the adoption and execution of an investment pol- icy. Comparatively little will be said about the technique of analyzing securities; attention will be paid to investment principles and investors’ attitudes. We shall, however, provide a number of condensed comparisons of specific securities—chiefly in pairs appearing side by side in the New York Stock Exchange list— in order to bring home in concrete fashion the important elements involved in specific choices of common stocks.

But much of our space will be devoted to the historical patterns of financial markets, in some cases running back over many decades. To invest intelligently in securities one should be fore- armed with an adequate knowledge of how the various types of bonds and stocks have actually behaved under varying condi- tions—some of which, at least, is likely to meet again in one’s own experience. No statement is more true and better applicable to Wall Street than the famous warning of Santayana: “Those who do not remember the past are condemned to repeat it.” These phenomena will have our careful consideration, and some will require changes in conclusions and emphasis from our previ- ous edition. The underlying principles of sound investment should not alter from decade to decade, but the application of these princi- ples must be adapted to significant changes in the financial mecha- nisms and climate. The last statement was put to the test during the writing of the present edition, the first draft of which was finished in January 1971.

At that time the DJIA was in a strong recovery from its 1970 low of 632 and was advancing toward a 1971 high of 951, with attendant general optimism. As the last draft was finished, in November 1971, the market was in the throes of a new decline, car- rying it down to 797 with a renewed general uneasiness about its future. We have not allowed these fluctuations to affect our general attitude toward sound investment policy, which remains substan- tially unchanged since the first edition of this book in 1949.