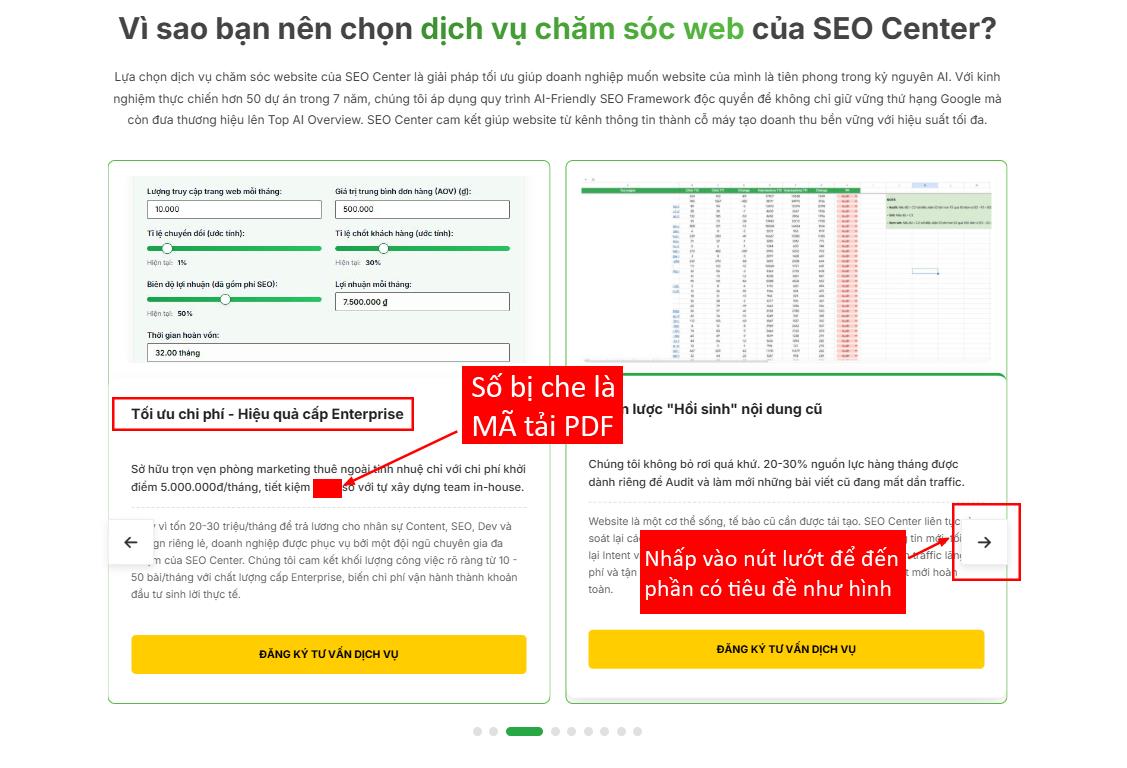

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

In the first session, not surprisingly, there wasn’t much difference between what the Group A and Group B participants did during that secretly watched eight-minute free-choice period. Both continued playing with the puzzle, on average, for between three and a half and four minutes, suggesting they found it at least somewhat interesting. On the second day, during which Group A participants were paid for each successful configuration and Group B participants were not, the unpaid group behaved mostly as they had during the first free-choice period. But the paid group suddenly got really interested in Soma puzzles.

On average, the people in Group A spent more than five minutes messing with the puzzle, perhaps getting a head start on that third challenge or gearing up for the chance to earn some beer money when Deci returned. This makes intuitive sense, right? It’s consistent with what we believe about motivation:

Reward me and I’ll work harder. Yet what happened on the third day confirmed Deci’s own suspicions

about the peculiar workings of motivation—and gently called into question a guiding premise of modern life. This time, Deci told the participants in Group A that there was only enough money to pay them for one day and that this third session would therefore be unpaid. Then things unfolded just as before—two puzzles, followed by Deci’s interruption.

During the ensuing eight-minute free-choice period, the subjects in the never-been-paid Group B actually played with the puzzle for a little longer than they had in previous sessions. Maybe they were becoming ever more engaged; maybe it was just a statistical quirk. But the subjects in Group A, who previously had been paid, responded differently. They now spent

significantly less time playing with the puzzle—not only about two minutes less than during their paid session, but about a full minute less than in the first session when they initially encountered, and obviously enjoyed, the puzzles.

We need to deal with something before we get too far into the issue of saving money. I want you to have a big pile of money in the bank. I want you to be able to buy nice things, cover emer- gencies without stress and panic, and have some cash on hand to bless other people. But every time I talk about saving and build- ing wealth, someone always comes up to me and says, “But if I save money and do the stuff you teach, I’ll become one of those evil rich people.” That’s a total disconnect about how God wants us to handle our money. Some people have a broken mind-set when it comes to wealth. They think that having money is somehow evil or wrong. That’s a huge misreading of Scripture. The Bible doesn’t say that money is the root of all evil; it says that the love of money is the root of all kinds of evil.² Money is amoral. It doesn’t have morals. It’s not good and it’s not bad. It’s the love of money that’s the prob- lem—and that’s a human problem, not a money problem.

Similarly, DTCC approached the SEC for rulemaking to protect its members from having to close out failed trades by forcing an open market purchase in a process known as “a buy-in” where the buyer can purchase the shares from another party and then charge back the cost to the seller who failed to deliver. This situation is getting worse instead of better. The more rules that are put in place to support this flawed infrastructure, the more the risk created by a build-up of unsettled trades in the system will look like the asbestos of the 21st century: just because fire-safety regulations required the use of asbestos in schools and public buildings in the 1970s did not make it any less dangerous in the 1990s. Likewise, just because financial regulations allow fails to deliver in the 2000s will not make it any less dangerous to the economy in the 2020s.