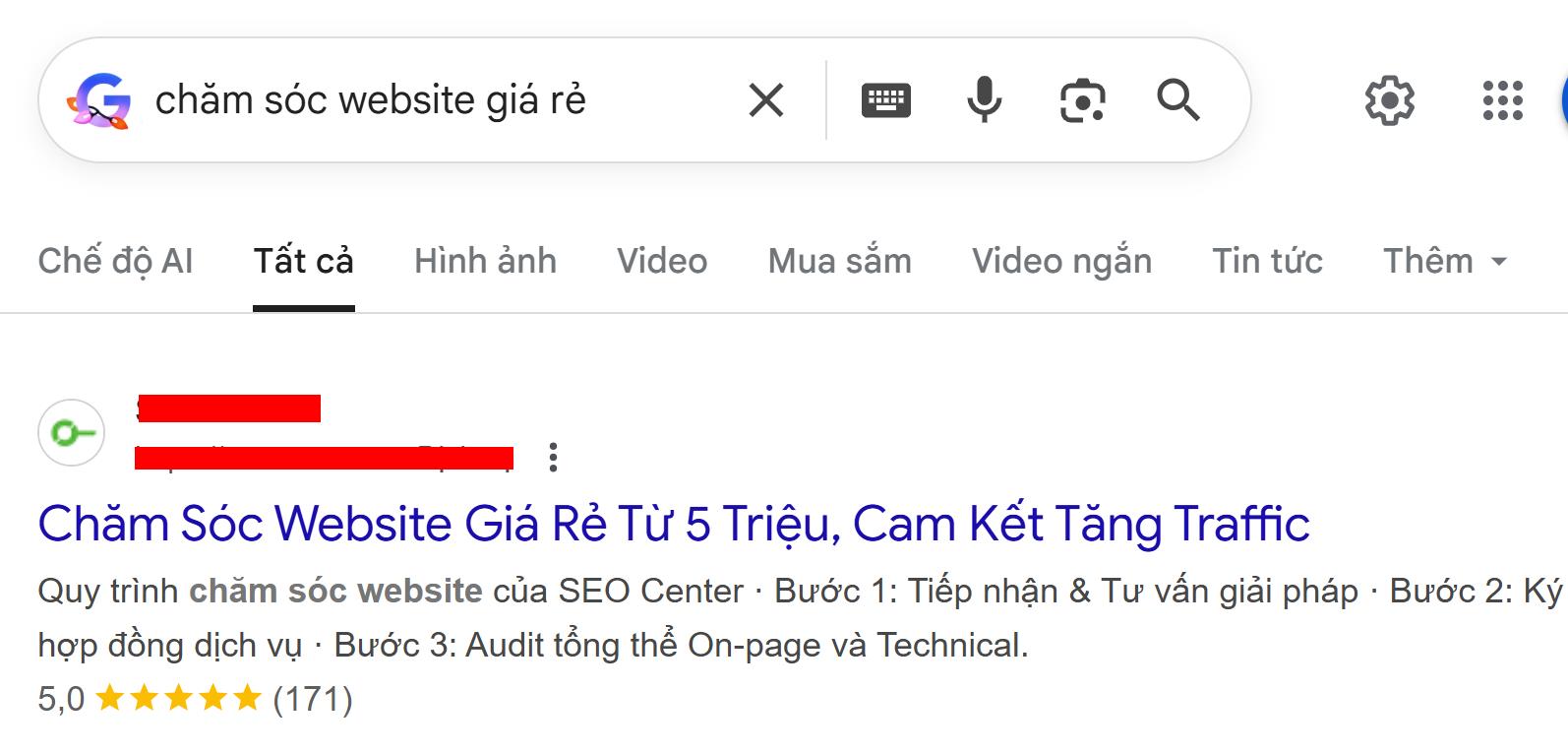

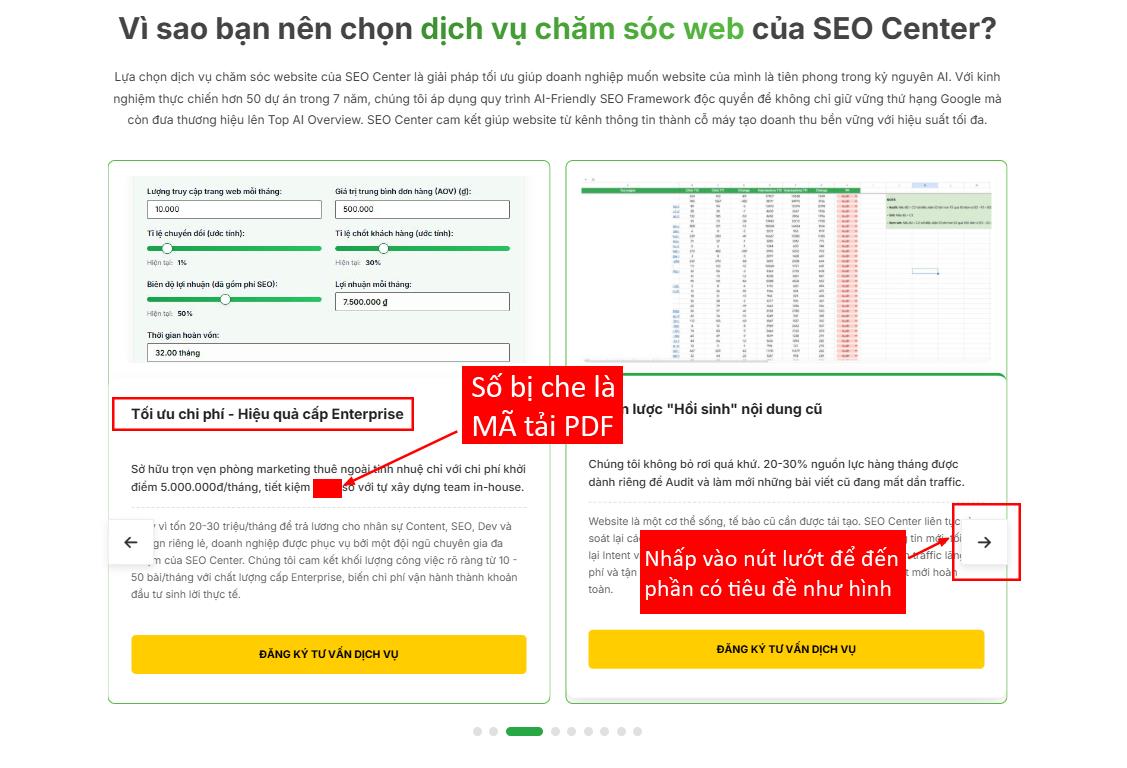

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

INVESTMENT BANKING, M&A ORIGINATION, EXECUTION, FINANCIAL MODELING & VALUATION

About the Author:

Michael Herlache is the VP of M&A at AltQuest Group, a boutique investment bank located in Fort Lauderdale, Florida. He lives in his home in Florida with his wife, Svitlana. Michael has an MBA in Finance from Texas A&M University and is getting his Doctorate in Business Administration with a focus on finance. To learn more about AltQuest Group, please go to www.AltQuest.com.

For those interested in going through a formal investment banking training program, the Investment Banking University (www.InvestmentBankingU.com) course’s syllabus is based upon the content of this book.

[Hình ảnh bìa sách “INVESTMENT BANKING” và một đĩa CD]

4

Investment Banking University

INVESTMENT BANKING, M&A ORIGINATION, EXECUTION, FINANCIAL MODELING & VALUATION

Contents

PERPETUITY SCIENCE:

Part I: Perpetuity Methodology

Chapter 1: Perpetuity Methodology

Part II: Standard of Living

Chapter 2: Standard of Living: Perpetuities & Investment

Part III: Perpetuities (Value)

Chapter 3: Perpetuities: Build or Buy

Part IV: Perpetuity Science (Value Creation)

Chapter 4: Business: The Science of the Perpetuity

FOUNDATIONS OF FINANCE:

Part V: Tracking Value (Accounting)

Chapter 5: Tracking Value with Accounts

Part VI: Analyzing Value (Finance)

Chapter 6: Analyzing Value with Finance

Chapter 7: Modeling Value

Chapter 8: Finance with Excel

Chapter 9: Financial Statement Modeling

BUILD-SIDE:

Part VIII: Perpetuity Analysis

Chapter 10: Perpetuity Science

Chapter 11: Market Analysis

Chapter 12: Value Chain Analysis

Chapter 13: Gap Analysis

Chapter 14: Product/Platform Analysis

Part IX: Perpetuity Building

Chapter 15: Perpetuity Building

Part X: Perpetuity Management

5

Investment Banking University

INVESTMENT BANKING, M&A ORIGINATION, EXECUTION, FINANCIAL MODELING & VALUATION

Chapter 16: Perpetuity Management

Chapter 17: Valuation Methodologies

Chapter 18: Framing Valuation

Chapter 19: The Market for Perpetuities

Chapter 20: Index Building & Benchmarking

Chapter 21: Financial Data Sources

SELL-SIDE:

Part XI: Perpetuity Exit

Chapter 22: Investment Banking

Chapter 23: How to Become an Investment Banker Methodology

Part XII: The Middle Market

Chapter 24: Middle Market Breakdown

Part XIII: M&A Multiples

Chapter 25: M&A Multiples

Part XIV: M&A Origination

Chapter 26: M&A Origination Methodology

Part XV: Mandate/Target Matching

Chapter 27: Mandate/Target Matching

Part XVI: Deal Structuring

Chapter 28: Deal Structuring

Part XVII: M&A Process

Chapter 29: M&A Process

Part XVIII: Firm Management

Chapter 30: Running the Boutique Investment Bank

Part XIX: Deliverables & Coverage

Chapter 31: Investment Banking Deliverables

Chapter 32: Coverage

Chapter 33: Index Building & Benchmarking

Chapter 34: Financial Data Sources

Chapter 35: Industry or Sector Newsletter

Chapter 36: Industry or Sector Report

Chapter 37: Rolodex Building

Chapter 38: Adjusted EBITDA

6

Investment Banking University

INVESTMENT BANKING, M&A ORIGINATION, EXECUTION, FINANCIAL MODELING & VALUATION

Chapter 39: Valuation

Chapter 40: Teaser

Chapter 41: CIM (Confidential Information Memorandum)

BUY-SIDE:

Part XX: Buying a Perpetuity

Chapter 42: The Principle of Investing

Chapter 43: How to Become the Next Warren Buffett

Chapter 44: The Operating Model

Chapter 45: The Financial Buyer aka Private Equity (LBO)

Chapter 46: The Strategic Buyer aka Corporation (Merger)

INVESTMENT BANKING, M&A ORIGINATION, EXECUTION, FINANCIAL MODELING & VALUATION

Preface

There are many investment banking texts out there that claim that financial modeling and valuation is the core work of the investment banker. This is simply not the truth. The core work of the investment banker is origination, mandate/target matching, and deal structuring. It should follow that a text/course on investment banking should be based upon the same. It is the good fortune that the reader has encountered such a book/course. Investment Banking: M&A Origination, Execution, Financial Modeling & Valuation explains origination, mandate/target matching, and deal structuring (i.e. how investment bankers make their money).

First, you are going to want to clarify whether you would like to work on the sell side for a few years or pursue a career in investment banking. The skills that you will need to get started in investment banking are different than those that you will need to have a long and successful career in investment banking. The role in investment banking transforms from one that is research, financial modeling & valuation based into one focused on origination and facilitating the M&A process. M&A (Mergers & Acquisitions) is the core product of investment banking, and the other products, advisory & capital-raising, simply support this. We founded Investment Banking University (www.InvestmentBankingU.com) to answer that very question and prepare students for both bulge bracket and middle market investment banking career opportunities. The following is a short free workshop presentation that we give to our prospective students that will help to answer your question.

As you can see, it helps to understand the bigger picture (perpetuity science) when trying to comprehend what will make for a successful career in investment banking and the investment banker’s role.

8

Investment Banking University

INVESTMENT BANKING, M&A ORIGINATION, EXECUTION, FINANCIAL MODELING & VALUATION

M&A is the core product for any investment bank and is thus the focus of this text. However, we will begin with an overview of the foundations of finance.

Finally, the idea that you need to spend three years of your life as an analyst doing 80+ hour workweeks building financial models to become an investment banker is a faulty paradigm. The real value add of an investment banker is not financial modeling & valuation, but rather origination, mandate/target matching, and deal structuring. You don’t need Goldman Sachs’s permission to be an investment banker just like you don’t need McKinsey’s permission to be a consultant.

The following is the How to Become an Investment Banker Methodology:

- Coverage

a. Index building

b. Vertical report

c. Vertical newsletter - Target screen & origination

- Mandate/target matching

- Deal structuring

- Buyer/seller meeting logistics

- Adjusted EBITDA calculation

- Valuation

- Offer analysis

- Purchase agreement drafting/structuring

- Due diligence data room

- Closing & flow of funds

Decide on the industry/industries that you will cover, read/research the value themes/players/multiples in the industry on the following levels:

- Large cap

- Mid cap

- Small cap

- Middle market

- Lower middle market

Pick an initial vertical and sub-vertical to cover. With AltQuest Group, our initial coverage groups were the following:

- Manufacturing

- Software

- Business Services

- Healthcare

After choosing your coverage, the investment banker is then to build an index for each of the verticals and sub-verticals made up with the public comps. The AltQuest Group coverage is broken down in the following manner:

- Manufacturing

a. Durable consumer

b. Non-durable consumer

c. Aerospace & defense

d. Building products

e. Industrial

f. Medical - Software

a. Traditional software

b. SAAS

c. Internet - Business Services

a. Education & Training

b. Business Process Outsourcing

c. Facility Services and Industrial Services

d. Human Resources

e. Information Services

10

Investment Banking University