Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

As FINANCIAL ADVISORS, WE operate in a dynamic, ever-changing investment world. New products, new programs, and new regula- tions impact the markets and our business. It is essential that we stay up to date and informed and that we build a relationship of trust with exist- ing and potential clients. One thing seems to always remain the same: Many potential clients have fears about working with financial advisors. They are intimidat- ed by the idea. They are not sure whom to trust with their life savings. Some don’t think they have enough money to invest, so, they don’t think a professional would help them much; or they think they can’t afford to use a financial advisor. In a word, many potential clients feel overwhelmed. Investment companies understand these fears, and some have built their advertising campaigns around the gap between client percep- tions and the reality of what their investment professionals can do for them.

As a financial advisor, do you know what you personally can do to close the gap, alleviate fears, and build trust with your client? This book is de- signed to help you discover actions you can take to create happy clients and lasting relationships with them. For more than two decades I have had the privilege of traveling around the country meeting with and speaking to groups of my fellow finan- cial advisors. In these professional gatherings I’ve been struck by the fact that what many advisors—both newly licensed and experienced veter- ans—consider to be their standard operating procedures are what I con- sider to be missed opportunities to build better, longer-lasting client relationships. I began jotting down the most common mistakes and missed opportu- nities I encountered. I then thought about the successful people I have met along the way whose suggestions and perspectives have had a big impact on my career. I asked myself several questions: How did they work with clients? Why were those clients loyal? What persuaded their clients to feel comfortable enough to introduce them to family, friends, and coworkers? I next thought about how I have built upon what I learned from oth- ers to create my own successful business. I also took an honest look at how I continue to make some easily remedied mistakes as if they were ingrained habits.

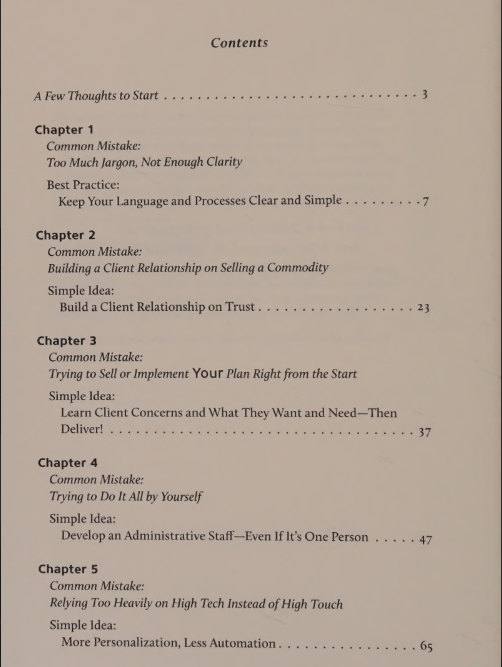

Looking for ways to improve my own skills, as well as sharing what I have learned along the way, is the genesis of this book. I compiled ten common mistakes and the simple, commonsense solutions to overcome them. My selections were based on both eliminating mistakes that keep financial advisors from delivering to their clients the highest-level experience possible and those mistakes that impede finan- cial advisors in expanding their business and client roster. The result is my philosophy on how to work with clients, and a plan of action that you can implement. My goal is to see things from the client perspective in ways that help them debt free, financially independent, and properly protected. It is a true honor to have clients entrust me with a large portion of their net worth and savings. Each mistake and its best-practice remedy are covered in a separate chapter. I use real-world client experiences, as well as several of my own, to illustrate specific issues and points. I’m sure many of you have run into similar situations. I’m also sure you’ll see how simple changes can have positive impacts.

One note about terminology: You’ll notice that throughout this book I use the title financial advisor. I do so because it is the title most com- monly used by clients, FINRA, the SEC and the Department of Labor. Of course, there are numerous other professional designations for the men and women who provide financial services. These include: * Registered Rep * Investment Advisor Representative * Investment Advisor * Registered Investment Advisor * Financial Planner * Certified Financial Planner * Personal Financial Specialist * Chartered Financial Analyst * Chartered Financial Consultant I am licensed as a Registered Rep and Investment Advisor Representative. No matter what your title or professional designation may be, I hope you gain a better understanding of how to minimize mistakes and improve the overall client experience. ONE VERY COMMON MISTAKE financial advisors make that frequently frustrates clients is, they don’t keep it simple.

Many financial advisors complicate their client discussions with in- dustry jargon, undefined terms, and information that soars over the listener’s head. Why do so many of us do this? I believe we do it out of insecurity—we want to appear not only smart but also invaluable. Financial markets can be complicated. Clients are entrusting us with their life savings, or at least a significant portion of it. We want to prove that we are smart, are worth doing business with, and that their invest- ments are in good hands. But when financial advisors overuse jargon or don’t take the time to explain terms, it is the client who becomes insecure. When hearing fi- nancial jargon pour out of a financial advisor’s mouth, all the client can concentrate on is defining an unfamiliar term in their head while miss- ing important details that follow. Clients don’t want to become experts