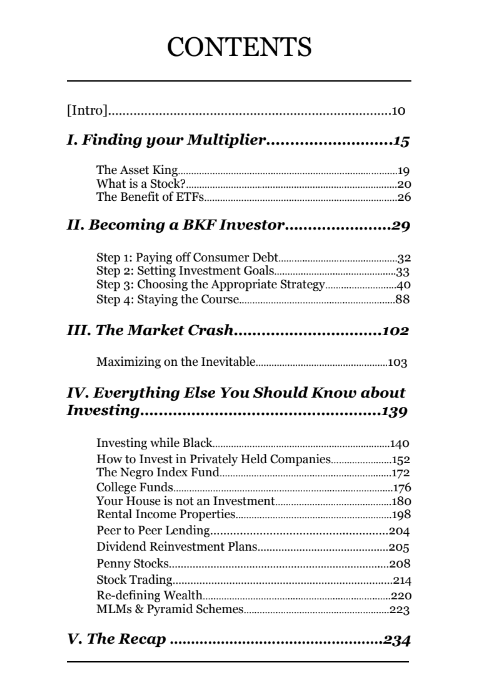

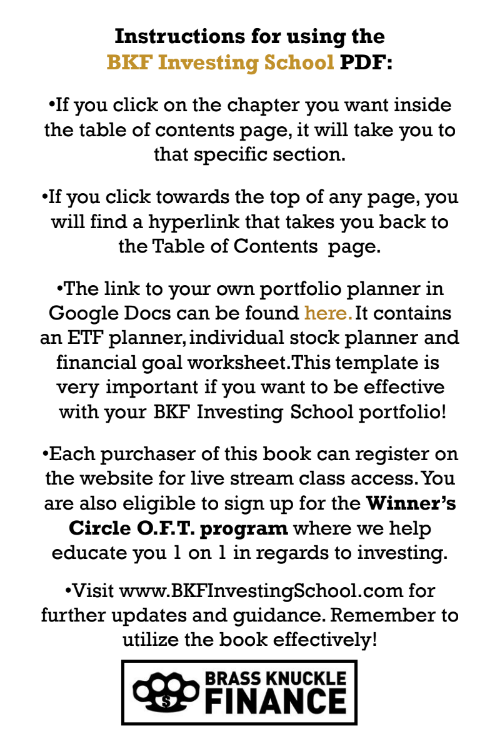

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

**Why Investing is Important:**

By now, most people know that their incomes are **important**. When you have an income, **regardless of what that income is**, you are miles ahead than if you did not. Now, as you should have learned in **Brass Knuckle Finance**, the **absolute best use** of that income, outside of the purchasing of food/shelter & basic necessities, is to help ourselves **get out and stay out of debt**. Then after we are out of debt and no longer paying interest to banks, we can then use this income to set money aside for the **type of future** we want (for ourselves and our families). Because even when we have a life without **debt**, many of us also know that the **average income** can only take us so far and that the average **savings account** can only take us so far.

At a certain point, our paychecks may not keep up with inflation. And over long periods of time, the balances in our savings accounts will **definitely not keep up with inflation**. When a company decides to raise money for expansion, research and development etc, that company will issue “equity” aka “stock” in their business to the Public. The **simplest way of thinking of a stock** is that it is a **share** in the **ownership** of a specific company. When you own a share of a publicly traded company, you basically have a small claim to everything that company owns and does.

And while it **is possible** to buy stock in just about any company in existence*, what we’re specifically referring to here is buying stock in **publicly traded companies**. A company that has issued securities through an initial public offering (IPO) and is traded on at least one stock exchange (such as the New York Stock Exchange) is considered a **publicly traded company**. These would be your Apples, Googles, Fords, Proctor and Gambles of the world.

Its important to know just how diversified we’re talking when we say ‘diversify or die’. In actuality, we don’t just lightly diversify our investments in BKF Investing School, we **massively** diversify our investments – across many different sectors in the market. And **what is a sector**? It’s an area in the stock market which contains a group of similar companies. There are even sectors that include companies of certain sizes – such as small sized (small cap), medium sized (mid cap) and larger companies (large cap). But what exactly does this mean for you? It means that your goal should be to create a portfolio that is diversified **across just** **about every sector** there is.

In other words, so that we avoid the fool’s errand of trying to make predictions and time the market, in BKF Investing School, our official motto is “**BEASTFU**”. (Buy **Everything** And Shut The F*k Up…) Now how do we do this in the most cost effective manner? …by building an investment portfolio made out of **Exchange Traded Funds**. Exchange Traded Funds are simply “**Mutual Funds**” – professionally managed groups of stocks – but without all of the fees and frequent buying & selling.

Using this approach of relying on massively diversified ETFs while not trying to time or outsmart the market throughout the year, has been statistically proven to provide the highest real returns compared to actively managed mutual funds who do the opposite.

An actively managed mutual fund or hedge fund may cost you 1-3% in fees and return 7% a year on average. This means you get a true return of 4-6% in most cases. And that’s BEFORE you pay taxes.

Your starting balance: First time investors who do not have much capital will generally be placing zero here. However, the minimum suggested to begin investing into a BKF portfolio is $2,000. Annual rate of return: Use 9.7% if you’re an investing in the BFK Millionaire Portfolio. For robo-advisors, use 7%. For target date retirement funds or any other actively managed mutual funds, use 6% as a conservative figure.

Monthly contribution: To figure this out, you’ll first want to figure out your annual contribution. Regardless of if you’re investing quarterly or not, for sake of calculation, divide the amount you’ve pledged to invest for the year, by 12 months, and whatever number that is, use it here. How many years will you contribute/how much will this investment be worth: Normally these numbers will be the same. But feel free to play around with the numbers here as well as your monthly contributions to see how various investment timelines & contributions affect your returns.