Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

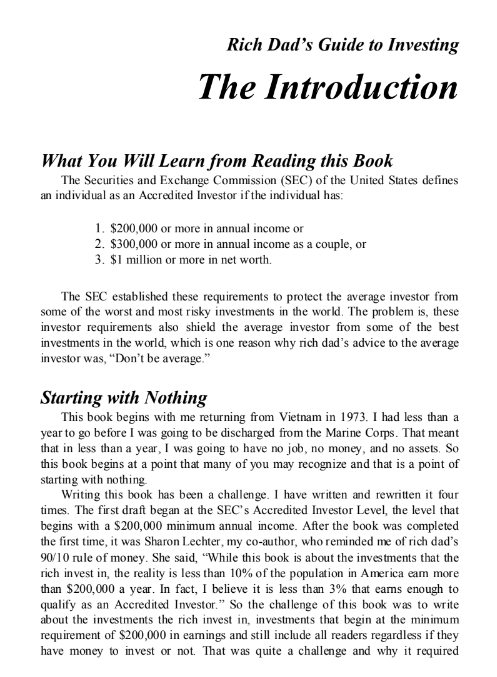

This book begins with me returning from Vietnam in 1973. I had less than a year to go before I was going to be discharged from the Marine Corps. That meant that in less than a year, I was going to have no job, no money, and no assets. So this book begins at a point that many of you may recognize and that is a point of starting with nothing. Writing this book has been a challenge.

I have written and rewritten it four times. The first draft began at the SEC’s Accredited Investor Level, the level that begins with a $200,000 minimum annual income. After the book was completed the first time, it was Sharon Lechter, my co-author, who reminded me of rich dad’s 90/10 rule of money. She said, “While this book is about the investments that the rich invest in, the reality is less than 10% of the population in America earn more than $200,000 a year.

In fact, I believe it is less than 3% that earns enough to qualify as an Accredited Investor.” So the challenge of this book was to write about the investments the rich invest in, investments that begin at the minimum requirement of $200,000 in earnings and still include all readers regardless if they have money to invest or not. That was quite a challenge and why it required writing and rewriting the book four times. It now begins at the most basic of investor levels and goes to the most sophisticated investor level. Instead of beginning at the Accredited Investor level, the book now begins in 1973 because that is when I had no job, no money, and no assets.

A point in life many of us have shared. All I had in 1973 was the dream of someday being very rich and becoming an investor who qualified to invest in the investments of the rich. Investments that few people ever hear about, or that are written about in the financial newspapers, or sold over the counter by investments brokers. This book begins when I had nothing but a dream and my rich dad’s guidance to become an investor who could invest in the investments of the rich.

So regardless if you have very little money to invest or have a lot to invest today, and regardless if you know very little about investing or you know a lot about investing, this book should be of interest to you. It is written as simply as possible about a very complex subject. It is written to include anyone interested in becoming a better informed investor regardless of how much money they have. If this is your first book on investing, and you are concerned that it might be too complicated, please do not be concerned. All Sharon and I ask is that you have a willingness to learn and read this book from the beginning to the end with an open mind. If there are parts of the book that you do not understand, then just read the words but continue on to the end. Even if you do not understand everything, just by reading all the way through to the conclusion of this book, you will know more about the subject of investing than many people who are currently investing in the market.

In fact, by reading the entire book, you will know a lot more about investing than many people who are giving investment advice and being paid to give their investment advice. This book begins with the simple and goes into the sophisticated without getting too bogged down in detail and complexity. In many ways, this book starts simple and remains simple although covering some very sophisticated investor strategies. This is a story of a rich man guiding a young man, with pictures and diagrams to help explain the often confusing subject of investing.

My rich dad appreciated Italian economist, Vilfredo Pareto’s discovery of the 80/20 rule, also known as the Principle of Least Effort. Yet when it came to money, rich dad was more aware of the 90/10 rule which meant that 10% of the people always made 90% of the money. The September 13, 1999, issue of The Wall Street Journal ran an article supporting my rich dad’s point of view on the 90/10 rule of money.

A section of the article read: “For all the talk of mutual funds for the masses, of barbers and shoe shine boys giving investment tips, the stock market has remained the privilege of a relatively elite group. Only 43.3% of all households owned any stock in 1997, the most recent year for which data is available, according to New York University economist Edward Wolf. Of those, many portfolios were relatively small. Nearly 90% of all shares were held by the wealthiest 10% of households. The bottom line: That top 10% held 73% of the country’s net worth in 1997, up from 68% in 1983.”

In other words, even though more people are investing today, the rich continue to get richer. When it comes to stocks, the 90/10 rule of money holds true. Personally I am concerned because more and more families are counting on their investments to support them in the future. The problem is that while more people are investing very few of them are well educated investors. If or when the market crashes, what will happen to all these new investors? The federal government of the United States insures our savings from catastrophic loss but it does not insure our investments.

That is why when I ask my rich dad, “What advice would you give the average investor?” His reply was, “Don’t be average.” How Not to Be Average I became very aware of the subject of investing when I was just 12 years old. Up until that age, the concept of investing was not really in my head. Baseball and football were on my mind but not investing. I had heard the word, but I had not really paid much attention to the word until I saw what the power of investing could do. I remember walking along a small beach with the man I call my rich dad and his son Mike, my best friend. Rich dad was showing his son and me this piece of real estate he had just purchased.

Although only 12 years old, I did realize that my rich dad had just purchased one of the most valuable pieces of property in our town. Even though I was young I knew that oceanfront property with a sandy beach in front of it was more valuable than property without a beach on it. My first thought was, “How can Mike’s dad afford such an expensive piece of property?” I stood there with the waves washing over my bare feet looking at a man the same age as my real dad, who was making one of the biggest financial investments in his life.

I was in awe of how he could afford such a piece of land. I knew that my dad made much more money because he was a highly paid government official with a bigger salary. But I also knew that my real dad could never afford to buy land right on the ocean. So how could Mike’s dad afford this land when my dad couldn’t? Little did I know that my career as a professional investor had begun the moment I realized the power built into the word “investing.”