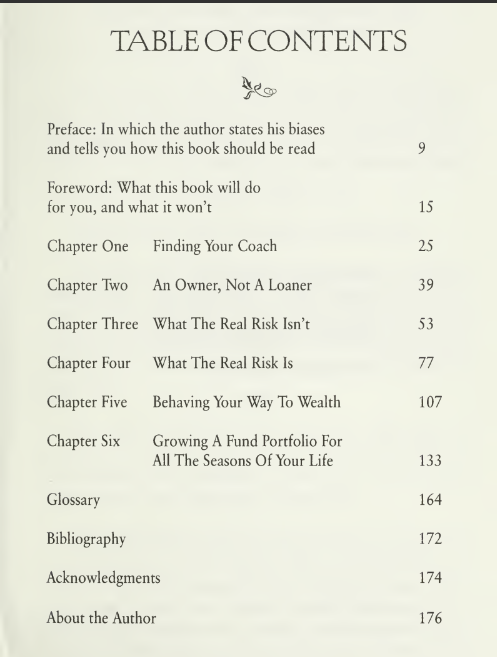

Bên dưới đây mình có spoil trước 1 phần nội dung của cuốn sách với mục tiêu là để bạn tham khảo và tìm hiểu trước về nội dung của cuốn sách. Để xem được toàn bộ nội dung của cuốn sách này thì bạn hãy nhấn vào nút “Tải sách PDF ngay” ở bên trên để tải được cuốn sách bản full có tiếng Việt hoàn toàn MIỄN PHÍ nhé!

Over the course of the last three decades, I’ve been an ad- visor to individual investors, and now – for want of a better description – an advisor to other financial advisors. This book will tell you absolutely everything of critical importance that I’ve learned about investing during that time. That’s the good news. It may also be the bad news. It’s potentially good news because if one labors diligently and lovingly at this profession for over thirty years, as I’ve tried to do, one learns an awful lot about how markets and investments really work.

I need hardly add that, in investing as in life, one learns virtually all great lessons the hard way. At least I did. One also discovers the few big things that really matter in successful investing. One does this by experimenting with, and then discarding, the multiplicity of stuff that turns out not to matter much, or to be just plain unknowable. That painstaking learning process at some point prompted me to say, “Let me write a little book for my fellow seekers of wealth, so that they can easily learn everything I know with- out having to make all my mistakes.

And in that book, let me tell people just the ultimate essentials, so that they don’t have to spend a lot of time and energy learning to filter out the noise.” There is, I promise you, a simplicity that lies beyond sophistication, and this book is my attempt to bring you di- rectly to that happy state, without stopovers, detours, or heavy lifting. That pretty much concludes the good news. The bad news (or at least the cautionary news) is this. Against every major point that this book makes, there’s a significant counter-argu- ment. These counter-arguments are often persuasively made, and by quite credible people. Here are three pertinent examples.

• Many reputable advisors, authors and financial planners believe that you should allocate your assets among stocks, bonds and cash, particularly as you grow older. They feel that this strategy strikes an appropriate balance between your need for good returns and your need for stability and protection of capital. I strongly disagree. I believe that if wealth is truly your goal, stocks aren’t part of the answer, they’re the only answer because – net of inflation and taxes – they’re the only financial asset that has any real return. Not a better return, mind you: any return.

• You will hear powerful arguments for owning individual stocks vs. investing in stock mutual funds. Peter Lynch makes this case, as cogently and charm- ingly as I’ve ever seen it made, in his first book, Beating the Street. I strongly disagree. I believe that most investors (not all, just most) will get much better returns from mutual funds – that is, from having professional investors manage their capital rather than trying to manage it themselves.

Just about everywhere you look these days, you’ll see suggestions that you run your financial affairs – especially your mutual fund investments – on your own, without the involvement (or the cost) of a financial advisor. This thesis is fueled by the explo- sion of Internet trading, of inexpensive sources of information including mutual fund ratings, and of low-cost/no-cost investment choices. I strongly disagree.

All my years and all my experience tell me that most investors will achieve far superior lifetime results – with far less pain and suffering – working with a trusted, knowledgeable financial advisor. These are my core beliefs. The point is that you’re entitled to treat them as my biases, and therefore you needn’t take them at face value. I’ve tried, in this book, to state both sides of each issue as fairly as I can… but you already know where I’m going to come out. So by all means read and listen to the countervailing arguments. If you can, speak to people who disagree with my beliefs… as well as some who may agree, but with reservations. I know that the principles and practices in this book are most families’ best chance to achieve wealth. But in order for this book to work for you, you have to believe in it as deeply as I do. Otherwise, walk away. Don’t just flirt with this stuff.

Don’t vacillate. Come all the way in, or go all the way out. Some other suggestions:

• Relax. Try to read this book straight through once just for enjoyment. Investing is supposed to make you feel good, and so is this little book. So take it easy, and have some fun with it.

• This book isn’t primarily about answers, or at least not about the answers you may be looking for (“Which six funds should I buy right now?”). It’s about making sure you get the really important questions framed right. Smart people in general, and good investors in particular, realize that you can never find the right answers until you’re sure you’re asking the right questions. (Examples: What are stocks? What is risk? What does wealth mean to me? Who am U)

• Although I’ve invited you to read this book critically, try not to argue with it on the first run-through. Even as you start coming to points you have trouble accepting (and you will), don’t get hung up on them right away. Read the book all the way through once for its fundamental logic; then go back, if you still need to and work on the things that trouble you.

You plant it in the earth, and a wonderful force of nature causes it to take root, and to grow. You don’t have to do much with it: the air and the water and the nutrients it needs are all % around the tree, and it knows how to use them. You don’t dig it up every ninety days to check on its progress. (Nothing much will have changed in that brief time, and you might harm the tree.) You don’t uproot the tree and store it in your garage over the winter, to protect it from what you regard as “bad weather.” (Though its leaves die and it stops growing for a season, the tree itself does not die.

And even leafless, the tree is still producing oxygen, without which you and I could not live.) Give the tree enough room, enough light, and enough time. Then leave it pretty much alone. It will give you back air and shade and beauty as it grows – and will go on doing so for your children, after you’re gone. That’s what investing is like – if you let it be. Wealth is no less organic than that tree; the growth of wealth in equity mutual funds is no less a force of nature. So here’s my last tip on how to read this book. Take it outside. Go sit under a tree. Read it slowly. Read it well. Know that time and nature are on your side. And know that it is a friend who is writing to you.